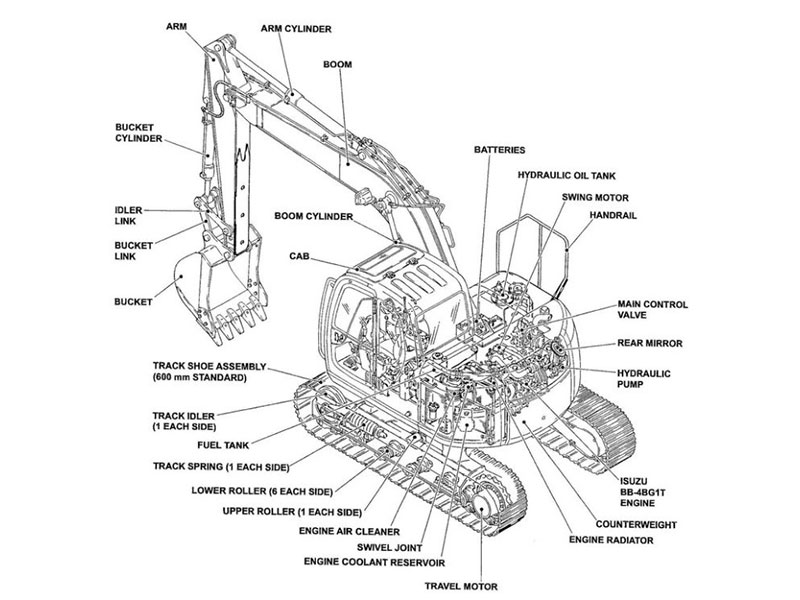

You might be asking, are excavation costs part of the land or building? For new construction, excavation costs are considered part of the building, not the land. According to US GAAP guidelines, such as ASC 360-10 and ASC 970-340-25-3, these costs should be capitalized as building costs because they prepare the building site for use. Understanding whether excavation costs are part of the land or building is crucial for accurate financial reporting and tax purposes. Excavation expenses can represent about 3% of total building costs, making them a significant factor to monitor. Knowing if excavation costs belong to the land or building ensures you record your costs correctly.

Key Takeaways

Excavation costs for new buildings are building costs. They are not land costs. These costs help get the site ready for the building.

Land costs are things like buying the land, paying legal fees, and tearing down old buildings. Land costs also include getting the land ready to use. But they do not include digging for building foundations.

Capitalizing costs means you record them as assets. You then spread out the expense over time. This helps match the cost with how you use the asset.

Use clear rules to keep land and building costs separate. Track costs carefully. Work with accountants to make sure records are correct.

When you buy land, tearing down old buildings and clearing the site adds to land value. But digging for building foundations is a building cost. Building costs lose value over time.

Accounting Rules

Capitalization Basics

It is important to know how capitalization works in construction accounting. Capitalization means you put construction costs as assets on your balance sheet. You do not count these costs as expenses right away. This way, you spread the cost over the asset’s useful life. You use capitalization for costs that help get an asset ready to use and give future benefits.

Here are some main rules for capitalization in construction accounting:

You capitalize costs that are directly for construction, like materials, labor, equipment rentals, permits, and interest on construction loans.

You expense indirect costs unless they are directly for the project.

Construction-in-Progress (CIP) accounting lets you keep costs as assets until the project is done. When the building is ready, you move the CIP balance to the fixed asset account.

Capital expenditures are costs that make the asset last longer or make it better.

Tip: Capitalization helps you match construction costs with the time you use the asset. This method gives you a better view of your finances.

Relevant Standards

Accounting standards tell you which costs to capitalize as land or building assets. For land, you capitalize the price, legal fees, commissions, back taxes, demolition costs (minus salvage), and local assessments needed to get the land ready. For buildings, you capitalize the price, remodeling costs, architect fees, permits, labor, materials, and interest during construction.

You should follow these main rules for capitalization:

Set minimum cost and useful-life rules so you do not capitalize small items.

Use a minimum capitalization rule of $5,000 for each item.

Make sure the asset will last at least two years.

Use different rules for land, buildings, and equipment.

Check capitalization rules often to keep them the same.

Capitalization is about giving good information for financial reports.

New updates in construction accounting say you should capitalize excavation costs for building construction as part of the building’s cost. If excavation makes the land better, you add it to the land’s cost. You need to have clear accounting rules and think about tax effects when you decide where costs go.

Asset Type | Capitalizable Costs | Minimum Threshold | Useful Life |

|---|---|---|---|

Land | Purchase price, legal fees, demolition, assessments | $5,000 | 2+ years |

Building | Construction, remodeling, architect fees, permits | $5,000 | 2+ years |

Note: Using the same capitalization rules helps you compare financial statements over time and follow accounting standards.

Are Excavation Costs Part of the Land or Building

If you wonder, “are excavation costs part of the land or building,” you need to know how accounting rules split these costs. For new construction, you usually count excavation costs as part of the building, not the land. This helps you record costs the right way and follow accounting standards.

Land Costs

You figure out land costs by looking at what you pay to get the land ready. These costs do not cover buildings or other structures. You add the cost of land when you buy it and get it ready for building. Here are some common land costs:

Type of Land Cost | Description and Examples |

|---|---|

Purchase Price | The contract price paid to acquire the land. |

Closing Costs | Fees for legal and administrative transfer, such as commissions, legal expenses, title search, and insurance. |

Site Preparation Costs | Clearing, grading, leveling, demolition (net of salvage proceeds), and environmental cleanup. |

Assumption of Liabilities | Liabilities taken on with the land purchase, such as mortgages, liens, and back taxes. |

Permanent Improvements | Landscaping, sewers, sidewalks that increase land value and are capitalized as part of land cost. |

Limited-Life Improvements | Parking lots, fences, driveways; recorded separately as land improvements and depreciated. |

Development Costs | Planning, permitting, and architectural fees to prepare land for future use. |

You include things like grading, draining, and tearing down old buildings in land costs. You also record land improvements, like parking lots and sidewalks, by themselves because they do not last forever. Land does not lose value over time because it lasts forever.

Tip: If you spend money to get the land ready for its main use, you usually add that cost to the land. Regular upkeep after the land is ready is counted as an expense.

Building Costs

You add building costs when you spend money to build, fix, or improve buildings. These costs cover everything needed to get the building ready to use. When you get the site ready for a new building, you count excavation costs as part of the building cost. This means you do not add excavation to land costs.

Here are some building costs that include excavation:

Taking away topsoil and making the ground flat for the foundation.

Digging trenches for things like water, electricity, and sewage.

Digging for basements, pools, patios, or driveways.

Clearing land after knocking down old buildings for new ones.

Grading land to fit building needs.

Building Cost Example | Excavation Expense Range (USD) |

|---|---|

Basement | $5,000 – $15,000 |

Patio or Driveway | $1,000 – $2,500 |

New Construction Foundation | $1,500 – $10,000 |

In-ground Swimming Pool | $400 – $1,500 |

Land Clearing | $1,400 – $5,800 |

Plumbing Trenches | $1,500 – $10,000 |

Landscaping | $500 – $6,000 |

Rock or Ledge Removal | $1,000 – $20,000+ |

Hillside Excavation | $1,000 – $5,000 |

You should know that building costs include all the money spent to get the building ready. Excavation for foundations, basements, and utility trenches are building costs. You do not add these to land costs.

Note: Industry rules say you treat costs up to excavation for a new building as land costs. When you start digging for the building foundation, you count those costs as building costs.

Practical Tips for Distinguishing Between Land and Building Costs

You can use different ways to split land costs from building costs during construction:

Figure out the replacement cost of the building and site improvements by themselves.

Work out depreciation on building improvements.

Find the market value of the land by looking at sales of similar empty land.

Take away depreciation from the replacement cost to get the building’s value.

Add the building’s value after depreciation to the land value for the total property value.

You should work with project managers and accountants to set clear cost codes. This helps you keep track of land and building costs the right way. Use accounting software or spreadsheets to keep your records neat. Teach your team about direct and indirect costs so everyone knows how to sort expenses.

Tip: Always check if a cost gets the land ready or the building ready. If the cost is for the building’s foundation or structure, you should count it as a building cost. If the cost makes the land better, you add it to land costs.

When you follow these steps, you can answer, “are excavation costs part of the land or building,” with confidence. You make sure you capitalize costs the right way and keep your construction project records correct.

Special Cases

Demolition and Site Clearing

You may face demolition and site clearing when you prepare land for new construction. Accounting standards say you should capitalize these costs as part of the land if you incur them during the purchase or lease of real estate and within a reasonable time. For example, if you buy a property and need to remove an old building, you add the demolition cost to the land’s value. If you get any money from selling salvage materials, you subtract that from the total cost.

If you clear the site or remove soil contamination as part of getting the land ready, you include these site preparation costs in the land’s cost. You do not depreciate land, so these costs stay on your books as part of the land asset.

However, if you pay for demolition long after you buy the land, you usually expense those costs right away. Always keep good records to show when and why you paid for demolition or clearing.

Improvements to Existing Land

When you improve land you already own, you need to decide how to record the costs. If you spend money to clear, level, or fill old foundations to get the land ready for its main use, you add these land preparation costs to the land’s value. You do not depreciate these costs.

If you add something new to the land, like paving, fencing, or walkways, you record these as land improvements. These have a set useful life, so you depreciate them over time.

Type of Cost | How to Record | Depreciation? |

|---|---|---|

Clearing/Leveling Land | Add to land asset | No |

Paving/Fencing | Land improvements | Yes |

Best practice says you should first figure out the value of the land. Use fair market value or local tax values. Then, separate land improvements and building costs. This helps you follow IRS rules and keeps your records clear if you ever face an audit.

You need to know that excavation costs for new buildings go with the building. They do not go with the land. To sort costs, check these main ideas:

Land does not lose value over time, but buildings do.

Split the price you pay between land and buildings using their appraised values.

Land improvements that do not last forever are counted by themselves.

Here is a simple checklist to help you sort costs:

Only count excavation as a capitalized cost if it helps get the land ready for its main use.

Put excavation together with other land preparation costs like grading or clearing.

Do not include costs that do not help the asset work.

Take away any money you get from selling salvage from the land cost.

Make sure all costs you capitalize are for a certain building or land asset.

If you have hard questions about building or land costs, talk to an accounting expert. They can look at your records, check your contracts, and make sure your financial statements follow all the rules.

FAQ

What are excavation costs?

Excavation costs are what you pay to dig dirt. You also pay to move or take away rocks. These costs help get the ground ready for building. You need them for foundations, basements, or utility lines.

Why do you classify excavation as a building cost?

Excavation is a building cost because it gets the site ready. It helps make space for the building’s foundation. Accounting rules say you add these costs to the building asset. You do not add them to the land.

Can you ever add excavation costs to land?

You add excavation costs to land only if they make the land better for its main use. This is not for a certain building. For example, grading or clearing land for general use is a land cost.

How do you separate land and building costs?

You can use appraisals or cost estimates to split costs. Market values also help you separate land and building costs. Always keep good records. Use cost codes to track each expense.

Do you depreciate excavation costs?

You depreciate excavation costs when they are part of the building. Land costs do not get depreciated. Only building costs, like excavation for foundations, lose value over time.